How I Wiped $24,000 Off My Federal Tax Bill (Legally)

A walkthrough of using the FEIE and Foreign Housing Exclusion

I made the jump and moved to Mexico. While the tacos and the lifestyle change were immediate wins, the tax benefits took a little longer to bake. Because I moved mid-summer, I didn’t qualify for the Foreign Earned Income Exclusion (FEIE) right away. I had to put in my time, a full calendar year, before I could finally reap the rewards of being an expat.

In previous years, I never qualified because I traveled back to the States too often. But thanks to a shift in how I work, I finally stayed south of the border long enough to make it count.

If you’re looking to make a similar move but aren’t sure where to start with the paperwork, check out my Mexico Move Blueprint & Residency Services. It’s the exact roadmap I used to get settled here without the headache.

The Strategy: TurboTax and the FEIE

My honest recommendation? Unless your tax situation is incredibly complex (think offshore corporations or multi-country shell companies), you can probably just use TurboTax.

I juggle both W2 income and self-employment earnings. With a simple record-keeping system, it’s been seamless. Here is exactly how the walkthrough looked for me:

1. The Setup When you load up TurboTax, make sure you check the box for “Worked outside the U.S.”

2. Starting the FEIE On the following page, navigate specifically to the Foreign Earned Income Exclusion section. This is where the magic happens.

3. The “Physical Presence” Test This is the only part that requires some “legwork.” You have to report exactly how many days you spent back in the U.S.

I took several 2-3 day business trips throughout the year. For the FEIE, you have to log each trip individually, and the money you earned while physically on U.S. soil is added back to your taxable income.

Pro Tip: Keep a folder with all your flight confirmations. You don’t need to upload them to file, but you’ll want them in your back pocket in case of an audit.

Stacked Deductions: The Math

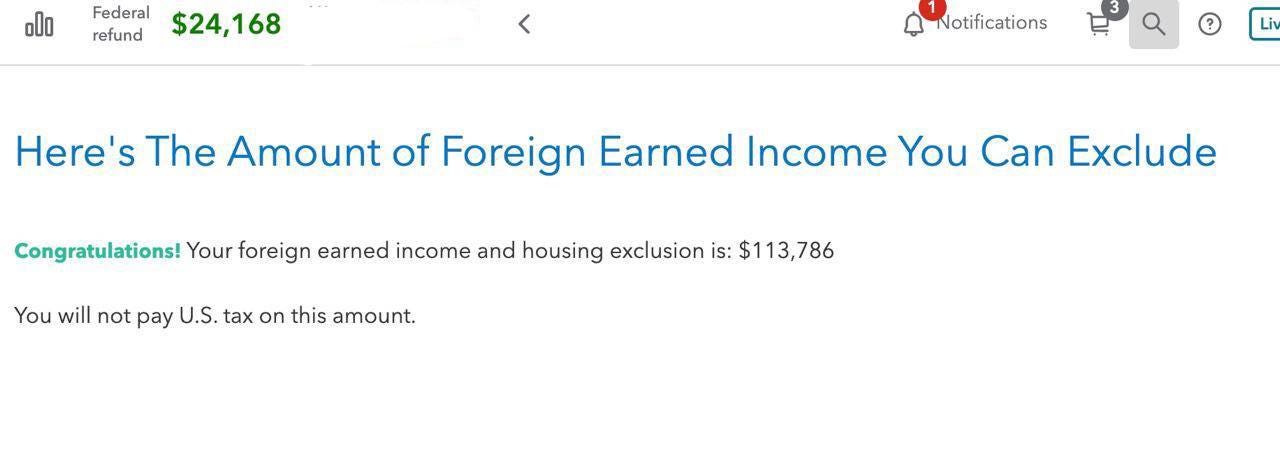

The FEIE is great, but I didn’t stop there. I also utilized the Foreign Housing Exclusion (FHE) to deduct my living expenses here in Mexico.

Between the Income Exclusion and the Housing Exclusion, I knocked off about $17,000. When I added my other standard deductions—mortgage interest, business expenses, and 401k contributions—I managed to “cross out” a massive percentage of my total tax liability.

The result? A $24,000 difference in what I owed versus what I kept.

Timeline & Closing Thoughts

I filed at the beginning of February and had my refund in hand by March 1st. It’s a faster process than most people expect, provided you have your dates organized.

While this process worked for me, everyone’s ledger looks different. I always recommend consulting with a tax professional to ensure you’re maximizing your specific situation.

The bottom line: Living in Mexico isn’t just a lifestyle upgrade; it’s a financial one. If you’re ready to stop “thinking about it” and start actually planning your move, let’s get your residency sorted.

Check out the Mexico Move Blueprint & Residency Services here.

Disclaimer: I am not a financial advisor. This post is for informational purposes and reflects my personal experience. Please consult a CPA or tax professional before filing.